How AURA Financial Fraud Protection Can Protect You from Identity Theft |2023|

In an age where our lives are increasingly intertwined with the digital realm, the threat of identity theft looms larger than ever. Imagine waking up one day to find your hard-earned money siphoned away, your credit score plummeting, and your financial reputation tarnished.

This modern-day nightmare is the stark reality of identity theft, a malicious act that can send shockwaves through your financial stability and emotional well-being.

In this article, we will discuss how AURA Financial Fraud Protection can protect you from identity theft. We will also provide tips on how to protect yourself from identity theft in general.

Identity Theft and Its Unseen Wounds

Identity theft isn’t just about a stolen wallet or misplaced identification; it’s an invasion of your personal fortress. Cybercriminals armed with sophisticated tools and strategies can slip through the smallest cracks in your digital armor, gaining access to your sensitive information like Social Security numbers, credit card details, and personal data.

The aftermath of such a breach isn’t just a mere inconvenience – it’s a harrowing journey through a maze of financial despair, emotional turmoil, and painstaking recovery.

Average Financial Loss and the Grueling Recovery

The financial repercussions of identity theft are nothing short of staggering. Recent data from 2022 paints a grim picture – the average victim of identity theft faced a loss of around $1,000.

About $10.3 billion was lost in 2022 and since 2020, the amount lost to digital crime has more than doubled according to the Federal Bureau of Investigation (FBI).

This isn’t just a number; it’s money earned through hard work, sacrifice, and dedication. However, the damage inflicted isn’t solely monetary.

The recovery process can be an excruciatingly long and uphill battle, consuming your time, energy, and mental resilience.

AURA Financial Fraud Protection

Enter AURA Financial Fraud Protection – your digital guardian, standing sentinel against the rising tide of identity theft.

In this world of ever-evolving cyber threats, Aura is your fortress, your shield, and your beacon of hope. It doesn’t just promise protection; it delivers peace of mind through a suite of proactive measures designed to thwart identity theft in its tracks.

AURA’s prowess lies in its ability to monitor your credit report like a hawk. It leaves no stone unturned, meticulously scanning for any signs of suspicious activity that might betray an intrusion into your financial realm.

This vigilance isn’t limited to the occasional glance; it’s an ongoing watch, a tireless sentinel that keeps you informed in real-time.

But that’s not all – it has your back with its arsenal of Suspicious Activity Alerts.

These aren’t just notifications; they are lifelines. The moment AURA detects an anomaly, it pings you with an alert, providing you with the upper hand to react swiftly and decisively. I

t’s like having a personal security detail for your finances.

And when the worst happens, and you find yourself facing fraudulent charges, they doesn’t just leave you to fend for yourself.

It steps into the ring with you, arming you with the tools and guidance you need to dispute those unauthorized charges.

AURA’s support isn’t just a lifeline; it’s a liferaft that helps you navigate the turbulent waters of financial fraud.

So, imagine a world where you can sleep soundly, knowing that your financial stronghold is safeguarded by Financial Fraud Protection tool.

It’s not just a solution; it’s a sanctuary for your financial well-being. In the battle against identity theft, AURA is your unwavering ally, your vigilant sentry, and your steadfast protector.

How AURA Financial Fraud Protection Works

At AURA, their mission revolves around fortifying your financial existence from the ever-looming specter of identity theft. Here, we unveil the arsenal of measures AURA employs to protect your economic well-being, ensuring you can navigate the digital world with confidence.

Here are a few ways Aura can help:

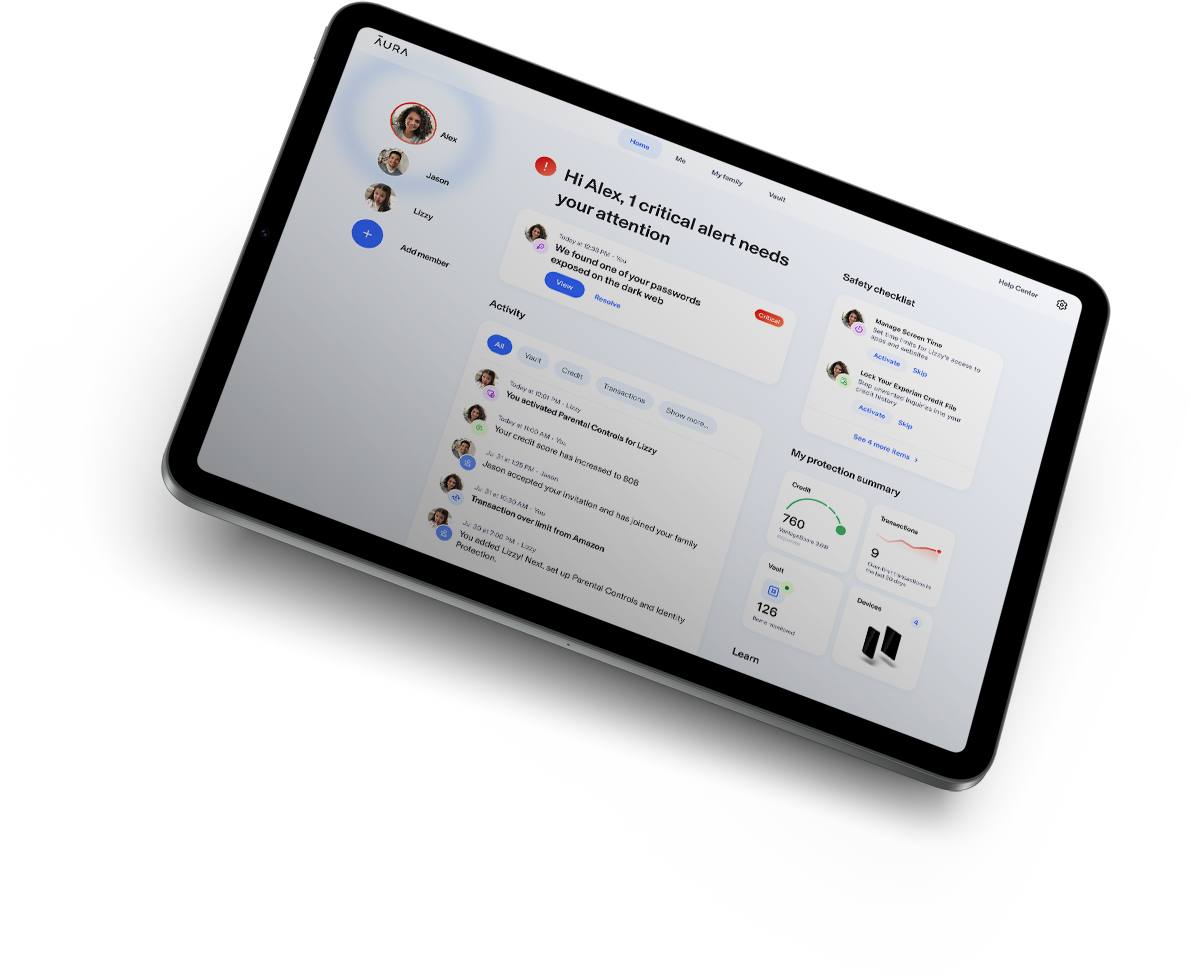

Credit Monitoring: Imagine having an ever-vigilant sentinel that stands guard over your credit files. With AURA’s credit monitoring, you’re not alone in this battle.

You receive notifications in near real-time whenever there are inquiries into your credit files across Equifax, Transunion, and Experian.

Credit Lock: A powerful tool at your fingertips, the Experian credit file lock empowers you to grant or deny access to your credit report. In essence, it’s like a digital deadbolt, allowing you to thwart unwanted inquiries with a simple click.

Credit Scores and Reports: Knowledge is power, and Aura arms you with it. Receive your monthly credit score and annual credit reports from major bureaus. This isn’t just about tracking numbers; it’s about understanding and actively managing your credit history.

Financial Transaction Monitoring: The digital age demands a vigilant eye on your financial streams. By linking your bank and credit card accounts, AURA ensures that every spending activity is under watch, providing you with a safety net against unauthorized transactions.

Bank Account Monitoring: Your financial stronghold isn’t confined to credit; AURA safeguards your bank accounts too. Any attempt to add unauthorized account holders or to tamper with your account details triggers an alert, preventing unwarranted access.

Lost Wallet Remediation: In the unfortunate event of a lost or stolen wallet, AURA steps in as your guide to recovery. From canceling debit or credit cards to formulating a plan to secure your IDs and information, AURA becomes your ally in chaos.

$1 Million Identity Theft Insurance: AURA isn’t just about defense; it’s about protection. Every plan comes with an insurance policy covering eligible losses and fees incurred due to identity theft, ensuring you have a safety net in the worst-case scenario.

Vigilance: The Essence of Credit Report Monitoring

Credit report monitoring isn’t just a feature; it’s the heartbeat of AURA’s defense strategy. Your credit report isn’t just a snapshot of your financial past; it’s a crystal ball that can foretell potential threats.

By constantly scrutinizing this vital document, AURA spots any irregularities that could hint at identity theft attempts. This proactive stance empowers you to counter threats before they escalate into financial catastrophes.

The Guardian Eye: Scanning for Suspicious Activity

In the digital wilderness, threats aren’t always glaring. AURA’s vigilant eye scans your financial landscape for telltale signs of suspicious activity.

Whether it’s an unauthorized transaction, an unexpected account change, or an unfamiliar inquiry, AURA’s algorithms are finely tuned to detect these digital breadcrumbs.

These scans aren’t just occasional glances; they’re continuous, tireless, and swift, ensuring that you’re always one step ahead of potential threats.

How AURA Financial Fraud Protection Can Help You Protect Your Money

1. Credit Report Monitoring

2. Suspicious Activity Alerts

3. Fraudulent Charge Dispute

1. Credit Report Monitoring: Unveiling the Guardian Sentinel

- Constant Vigilance: AURA’s watchful eye never sleeps. It monitors your credit reports around the clock, 24/7, ensuring that even the slightest anomaly doesn’t go unnoticed.

- Proactive Defense: Early detection is the cornerstone of prevention. By identifying suspicious changes promptly, AURA equips you with the power to halt potential threats in their tracks.

2. Suspicious Activity Alerts: Swift Notifications for Action

- Guardians of Alertness: AURA’s Suspicious Activity Alerts are like sentinels that don’t just observe; they alert. The moment AURA senses an unusual transaction or an unexpected activity, it sends you an immediate notification.

- Timely Empowerment: In the digital age, every second counts. AURA’s timely alerts arm you with the knowledge you need to take swift action, thwarting potential fraud before it gains a foothold.

3. Fraudulent Charge Dispute: From Defense to Action

- Partner in Dispute: When faced with fraudulent charges, you’re not alone. AURA stands by your side, guiding you through the process of disputing unauthorized transactions.

- Convenience Meets Support: Navigating the murky waters of fraudulent charges can be daunting. AURA’s support isn’t just about convenience; it’s a lifeline that provides the guidance and reassurance you need during a challenging time.

In the battle against identity theft, AURA Financial Fraud Protection stands as a beacon of hope, a digital fortress, and a guardian of your financial sovereignty.

But, as the saying goes, knowledge is power. In the upcoming section, we arm you with a toolkit of essential practices that, combined with AURA’s protection, create an unbreakable shield against identity theft.

Tips for Protecting Yourself from Identity Theft

In a world where the virtual landscape can be as treacherous as it is enticing, fortifying your defenses against identity theft is paramount.

While Aura stands as a guardian, your own practices play a pivotal role in safeguarding your financial fortress.

Here, we unveil a toolkit of practices that, when combined with AURA’s vigilance, create an impenetrable shield against identity theft.

1. Strong Passwords and Multi-factor Authentication: Locking the Gates

Strong passwords and multi-factor authentication (MFA) are two of the most important tools you can use to protect your digital security.

1. Championing Complexity: The gateway to your digital kingdom starts with a password. Advocate for robust, complex passwords that weave together a tapestry of letters, numbers, and symbols. It’s not just about securing access; it’s about erecting barriers that deter even the most persistent intruders.

Here are some tips for creating strong passwords:

- Use a combination of letters, numbers, and symbols.

- Make your password at least 12 characters long.

- Avoid using personal information that is easily guessed, such as your name, birthdate, or pet’s name.

- Don’t use the same password for multiple accounts.

- Consider using a password manager like Aura password manager to help you generate and store strong passwords for all of your accounts. You can also check out the best password Managers in 2023 here.

2. Embracing Multi-factor Authentication: Your first line of defense shouldn’t be your last. Multi-factor authentication adds an extra layer of protection by requiring an additional verification step beyond your password. This might involve a text message, fingerprint scan, or a verification app. It’s a virtual drawbridge that only you can lower.

Here are some tips for using MFA:

- Enable MFA on all of your important accounts.

- Keep your MFA codes and devices secure.

- Be aware of phishing scams that try to steal your MFA codes.

By following these tips, you can create strong passwords and use MFA to lock down your digital gates and protect your accounts from unauthorized access.

2. Secure Wi-Fi and Online Practices: Fortifying Your Digital Castle

Your Wi-Fi connection is not just a convenience; it’s also a potential vulnerability. By following these tips, you can protect your data and devices when using public Wi-Fi:

- Choose secure, password-protected networks: When possible, connect to Wi-Fi networks that require a password. This will help to protect your data from being intercepted by hackers.

- Avoid connecting to public Wi-Fi networks in unsecure areas: If you must connect to a public Wi-Fi network, avoid doing so in unsecure areas, such as airports, coffee shops, or hotels. These areas are often targeted by hackers because they know that people are more likely to be careless with their data in these settings.

- Use a VPN: A VPN like SurfShark VPN encrypts your traffic so that it cannot be intercepted by hackers. This is a good option if you need to connect to a public Wi-Fi network but you are concerned about your security.

- Keep your software up to date: Software updates often include security patches that can help to protect your devices from vulnerabilities. Make sure to keep your software up to date to protect yourself from the latest threats.

- Public Networks and Sensitive Activities:

Public Wi-Fi networks can be convenient, but they are also a security risk. If you must use a public Wi-Fi network, avoid conducting any sensitive activities, such as banking or accessing confidential accounts. These activities are more likely to be targeted by hackers, so it is best to wait until you are connected to a secure network.

3. Be Cautious with Personal Information: The Power of Skepticism

- Guardians of Information: Your personal information is valuable, so it is important to be cautious about who you share it with. When you are online, be careful about what information you provide to websites and apps. Only provide the information that is absolutely necessary.

- Unmasking the Scams: There are many scams that target people’s personal information. Be aware of common scams, such as phishing emails and fraudulent calls. If you receive an email or call that asks for your personal information, be skeptical. Do not click on any links in the email or provide any personal information over the phone.

Here are some additional tips for protecting your personal information:

- Use strong passwords and change them regularly.

- Enable two-factor authentication on your accounts.

- Be careful about what information you share on social media.

- Be wary of offers that seem too good to be true.

- Report any suspicious activity to the authorities.

By following these tips, you can help to protect your personal information and keep your accounts safe.

4. Regularly Review Financial Statements: The Watchful Eye

- The Importance of Vigilance: It is important to be vigilant about your financial statements because it can be difficult to spot fraudulent activity on your own. Fraudsters are becoming more sophisticated, and they are constantly finding new ways to steal money. By regularly reviewing your financial statements, you can identify any unauthorized transactions early on and take steps to protect yourself.

- Setting Up Alerts: You can set up alerts for account activity to help you stay on top of your finances. These alerts can be triggered by a variety of events, such as a large withdrawal, a new transaction, or a change in your account balance. This will give you an early warning system so you can investigate any suspicious activity immediately.

5. Monitor Credit Reports Independently: AURA’s Partner in Prevention

- Annual Credit Report Check: You should check your credit reports from the major bureaus annually. This is a free service that is available to everyone. It is important to review your credit reports for any errors or fraudulent activity. If you find any errors, you should dispute them immediately.

- Synchronizing with AURA: AURA is a credit monitoring service that can help you protect your financial information. AURA uses a variety of methods to monitor your credit, including continuous monitoring, alerts, and identity theft protection. You can synchronize your independent credit report checks with AURA to get the most comprehensive protection possible.

In the battle against identity theft, AURA Identity Theft Protection is your stalwart ally. But remember, the fortress of protection isn’t a solitary effort; it’s a collective journey where your practices align with AURA’s safeguards.

By championing strong passwords, embracing multi-factor authentication, and cultivating a vigilant mindset, you craft a shield that no identity thief can breach.

Combined with AURA’s unwavering vigilance, you emerge not just as a defender, but as a victor in the quest for financial security.

Conclusion

As we navigate the intricate realm of identity theft prevention, one truth remains steadfast – security is not a luxury; it’s a necessity.

The digital age has brought us unparalleled convenience, but with it, the lurking shadows of cyber threats.

However, armed with AURA Identity Theft Protection and armed with the knowledge gleaned from these tips, you possess the tools to stand against the tide of identity theft and emerge victorious.

In the realm of digital warfare, AURA stands as your guardian, your sentinel, and your confidant. Its credit monitoring, vigilant alerts, and resolute support serve as an unyielding fortress that guards your financial well-being.

And as your digital ally, AURA doesn’t just offer a defense – it offers peace of mind.

The time to act is now. Your financial security deserves unwavering attention, and AURA Financial Fraud Protection is here to provide it.

Don’t let the specter of identity theft cast a shadow over your life. Instead, step into the light of protection, armed with the knowledge, the tools, and the unwavering support of AURA.

Ready to Secure Your Tomorrow? Sign Up Today!

Take the first step toward fortifying your financial universe. Embrace the power of AURA and the resilience of these practices.

Safeguard your identity, your future, and your peace of mind. In a world where threats are digital and protection is paramount, AURA Financial Fraud Protection stands as your beacon of safety.

Sign up now and embark on a journey towards a more secure, confident, and resilient financial future. Your fortress awaits – let AURA be your shield against the storms of identity theft. Start Free Trial